There is a lot of uncertainty in the air.

Some believe that Bitcoin’s price will surpass $200K during this halving cycle; Others think we may see a crash similar to the 2017 crash.

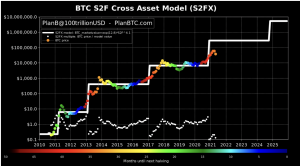

PlanB is a notable analyst, and he is just one voice forecasting BTC surpassing the 200K mark sometime during the next 3-4 years.

In a recent report, PlanB points out that the pullbacks we are seeing in BTC right now remind him more of the 2013 pullbacks and rallies—not the 2017 price action pattern.

PlanB could be right or he could be wrong, but his analysis is worth taking a look at:

$BTC #BTC #Crypto

Here are some findings that estimate the date range to when we will likely top the 2021 #Bitcoin rally, the crazy thing is the end prices coincide with the famous PlanB – @100trillionUSD S2Fx Model Price of $288k. pic.twitter.com/C29E3HB4KP— Nicholas Ilechie (@nicholasilechie) May 25, 2021

Coin Telegraph presented PlanB’s case:

After its drop to $30,000 and several retests of that level, concerns are starting to appear over a bigger drop taking BTC/USD toward $20,000 and lower.

This would mean that for the first time, Bitcoin crosses the all-time high from a previous bull market, in this case from 2017.

For PlanB, however, such an event is unlikely. Moreover, recent price action is far from unheard of — in fact, it could just mean that the market is rehashing its 2013 — rather than 2017 — performance.

Uploading the latest incarnation of his stock-to-flow cross-asset (S2FX) model, he highlighted similarities between 2021 and Bitcoin’s behavior from years long past.

“New dot: May close $37,341.. -35% .. we knew bitcoin would not go up in a straight line and several -35% drops are possible (and indeed likely) in a bull market,” he wrote in accompanying comments.

Just to be clear: I do not think $60K was the top, far from it, because I do not see the kind of transactions that normally happen after an ATH (red dots). In fact, I think we are just a couple of months out of the bear market (blue dots). And yes, this on-chain view fits S2F(X). pic.twitter.com/omLh23MsrX

— PlanB (@100trillionUSD) May 18, 2021

Coin Telegraph also offered a contrasting perspective:

Bitcoin (BTC) faces the prospects of falling further even after its price made a strong recovery after crashing from $65,000 to $30,000 in May 2021.

So, it reflects in the latest statements from Peter Brandt, chief executive of global trading firm Factor LLC, who questioned, if not asserted, the longevity of the ongoing relief rally in the Bitcoin market, especially after a 50%-plus price crash.

The veteran commodity trader challenged “BTC price historians” to identify a single instance in the last decade that saw Bitcoin logging a new record high seven months after crashing more than 50%. He also asked to refer to one case when a 50% decline in Bitcoin’s price did not lead up to at least a 70% correction.

One of the Twitterati responded with two instances: the March 2020 rebound, wherein Bitcoin’s price recovered to its all-time high above $20,000 eight — if not seven — months after crashing to $3,850 in March from its long-term cyclical high of $13,880 in June 2019; and the 2013 bull run that saw the cryptocurrency rising by more than 2,450% eight months after bottoming out near $45 in an 80% overnight crash.

Brand said, “nope to both,” apprehensively because Bitcoin’s prices took an additional month to reclaim their record highs in both cases. Nevertheless, the veteran’s questions remained cryptic enough due to its selective timeframe and as to what they were attempting to prove about the crypto market bias in the first place.

Want more? To stay up to date on all our news, please follow us on Facebook here:

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!