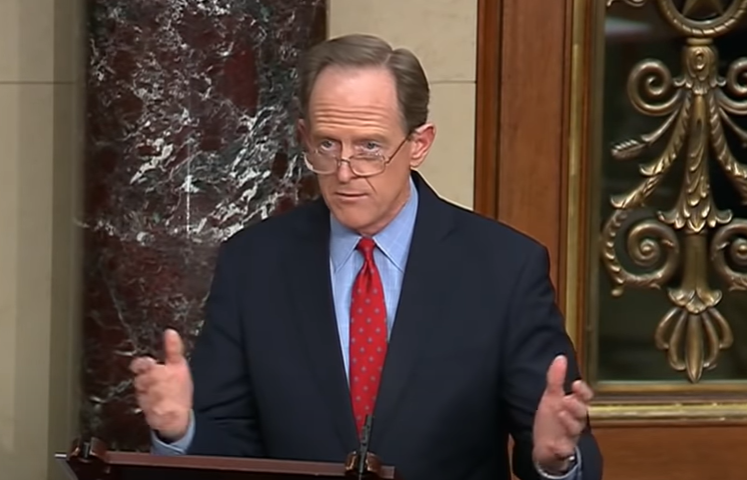

Senator Pat Toomey of Pennsylvania has spoken out against the 1 trillion dollar bipartisan infrastructure bill.

Sen. Toomey along with Sen. Ron Wyden have both stated that the hidden cryptocurrency within the infrastructure bill needs to be fixed immediately.

The Senate Banking, Housing and Urban Affairs Committee which is lead by Toomey released a statement which read “Congress should not rush forward with this hastily-designed tax reporting regime for cryptocurrency, especially without a full understanding of the consequences”.

In a separate statement Toomey declared he will work on an amendment to fix the cryptocurrency tax hidden within the infrastructure bill but didn’t add any details on how he would do so.

The senator says "Congress should not rush forward with this hastily-designed tax reporting regime for #cryptocurrency without a full understanding of the consequences." #bitcoin #infrastructurebill https://t.co/oOPGas9w4N

— Bitcoin News (@BTCTN) August 3, 2021

Sen. Pat Toomey (R-PA) calls text of the bipartisan infrastructure bill "unworkable": by @jason_vtf https://t.co/BTS6VKnrcg

— Forbes Crypto (@ForbesCrypto) August 3, 2021

News.Bitcoin had these details to add to the story:

Several U.S. lawmakers have spoken up against the cryptocurrency tax provision in the $1 trillion infrastructure bill. While the bill has been revised from last week’s version, the text is still “unworkable,” according to Senator Pat Toomey. “I plan to offer an amendment to fix it.” Other lawmakers, including Sen. Ron Wyden, Rep. Warren Davidson, and Rep. Ted Budd have also voiced concerns.

The U.S. Senate Committee on Banking, Housing, and Urban Affairs issued a statement by Ranking Member Pat Toomey Monday on a provision in the bipartisan infrastructure package that would tax cryptocurrency transactions. The statement reads:

Congress should not rush forward with this hastily-designed tax reporting regime for cryptocurrency, especially without a full understanding of the consequences. By including an overly broad definition of broker, the current provision sweeps in non-financial intermediaries like miners, network validators, and other service providers.

The senator from Pennsylvania added: “Moreover, these individuals never take control of a consumer’s assets and don’t even have the personal-identifying information needed to file a 1099 with the IRS. Simply put, the text is unworkable. I plan to offer an amendment to fix it.”

It looks like Senators Wyden & Toomey are trying to fix the crypto provisions in the Infrastructure Bill.

Fingers crossed!https://t.co/XufFrA7kIW

— Army of Spies (@ArmySpies) August 3, 2021

Forbes got the scoop too:

Today, Ranking Member Pat Toomey (R-PA) of the Senate Banking Committee issued a press release through the Committee urging Congress not to move forward with new cryptocurrency information reporting text of the infrastructure bill. Calling the language ‘unworkable’, he proclaimed that he would be offering an amendment to fix it. A portion of the Infrastructure bill applying to cryptocurrency tax reporting had come under scrutiny late last week with respect to some unintended and far-reaching consequences to the way the language was written.

Toomey stated, “Congress should not rush forward with this hastily-designed tax reporting regime for cryptocurrency, especially without a full understanding of the consequences.” The language regarding the cryptocurrency tax reporting could be the first law in the U.S. and its inclusion in a ‘must-pass’ infrastructure bill raised flags regarding how quickly this policy might have been constructed.

Toomey focused on what many critics have been pointing out regarding the definition given for a ‘broker’ as it relates to IRS reporting (not as a broker specific to securities). “By including an overly broad definition of broker, the current provision sweeps in non-financial intermediaries like miners, network validators, and other service providers.” In cryptocurrency, the Bitcoin miners or in other blockchain networks, the validators, are compensated ‘block rewards’ as well as ‘fees’ for confirming transactions in the network.

Want more? To stay up to date on all our news, please follow us on Facebook here:

Join the conversation!

Please share your thoughts about this article below. We value your opinions, and would love to see you add to the discussion!